Next Generation Invoice Finance

Collateral free business loans against your receivables. Use our expertise, partnerships with capital providers, and cutting-edge technology platform for supply chain funding products like sales and purchase invoice finance, invoice discounting, bill discounting, and a number of other working capital solutions.

The LivFin

Advantage

How It

Works

1

2

3

4

1

2

3

4

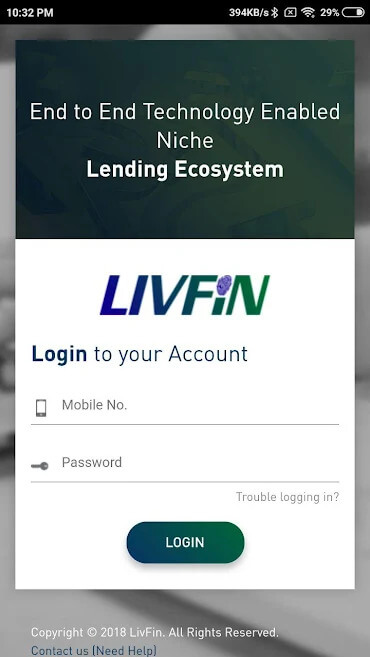

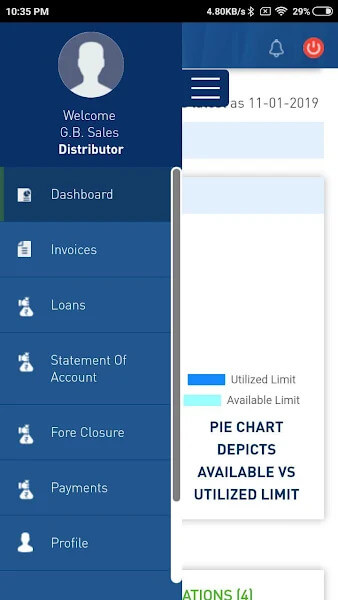

LivFin Online App

A Loan Management Tool

A seamless service that can be availed from anywhere, anytime. Our online dashboard is a revolutionary system to enhance efficiency and transparency for you to manage your LivFin credit limit. The system provides you access to:

- On-line Loan Application

- Self Service or Assist Modes

- Digital Loan Documentation / E-Sign

- Digital Invoice Acceptance

- Disbursement / Digitized Self Drawdown

- Limit Utilization Monitor

- Customer Service Requests